Corporate Responsibility

Although we began in 1910 as a local source of capital for the energy industry, we’ve grown to become one of the strongest, most vibrant financial institutions in the country, fueling economic growth and security across the American Midwest and Southwest, serving a broad spectrum of industries, institutions, and individuals across the country. But even as we grow, the deep ties to the communities we serve drive our support of initiatives related to community advancement to levels well beyond the typical corporate commitments to education and job training in both size and scope.

Additionally, our majority shareholder and chairman of the board, George Kaiser, initiates and funds major programs directed toward these purposes, further amplifying our corporate commitment. Mr. Kaiser created the George Kaiser Family Foundation whose mission is to create an environment where every family has an opportunity to succeed. As a signatory of the Giving Pledge, he has committed to giving the majority of his wealth—well exceeding the net income and value of the company—to philanthropic or charitable causes.

Our strong client focus, dedicated employees, community commitment and solid governance are just some of the factors that have driven the company’s success in the past—and will no doubt enable another century of growth.

At BOK Financial, we know that the health of our company and ability to deliver sustained shareholder value are deeply connected to the wellbeing of our clients, employees and communities we serve. That knowledge—paired with our core values—informs the disciplined approach we take to managing, safeguarding and growing our company. And that disciplined ability to stay true to who we are and how we conduct ourselves drives our continued success.

In this corporate responsibility review, we explore just some of the ways that BOK Financial delivers returns to our stakeholders, whether that takes the form of our rigorous approach to risk management or our strategic approach to supporting local nonprofits. Hopefully, it demonstrates our commitment to making the right decision each and every day on big things and small things.

We recognize that our work as a responsible corporate citizen is never ending, and we embrace that. Our commitment to making a difference by serving with a purpose has never wavered since we were founded more than a century ago. I stand with our more than 5,000 employees in celebrating what we accomplished in 2024 and committing to continue doing even better in years to come.

Stacy C. Kymes

President & CEO

About us

BOK Financial is a top U.S.-based financial services company, offering sophisticated wealth, commercial, and consumer products and services. Still, we do business one client at a time, focused on delivering thoughtful expertise and tailored advice, because we know that when our clients succeed, we succeed.

Strategic priorities

- Accelerate top-line growth

- Manage risk

- Win as a talent magnet

- Advance technology

$524MM

Net income in 2024

$531 million net income in 2023

$520 million net income in 2022

5,056

Full-time employees in 2024

4,966 full-time employees in 2023

4,791 full-time employees in 2022

Average Loans ($MM)

Average Deposits ($MM)

Reference

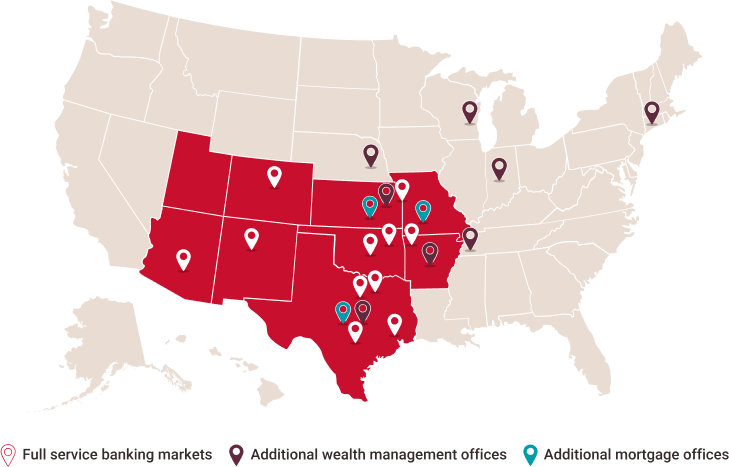

BOK Financial Corporation is a regional financial services company headquartered in Tulsa, Oklahoma. The company’s stock is publicly traded on NASDAQ under the Global Select market listings (BOKF). BOK Financial Corporation’s holdings include BOKF, NA; BOK Financial Securities, Inc.; and BOK Financial Private Wealth, Inc. BOKF, NA operates TransFund and Cavanal Hill Investment Management. BOKF, NA operates banking divisions across eight states as: Bank of Albuquerque; Bank of Oklahoma; Bank of Texas and BOK Financial (in Arizona, Arkansas, Colorado, Kansas and Missouri); as well as having limited purpose offices in Nebraska, Wisconsin, Connecticut and Tennessee. Through its subsidiaries, BOK Financial Corporation provides commercial and consumer banking, brokerage trading, investment, trust and insurance services, mortgage origination and servicing, and an electronic funds transfer network. BOK Financial® is a registered trademark of BOKF, NA. For more information, visit bokf.com.

This review contains forward-looking statements that are based on management’s beliefs, assumptions, current expectations, estimates and projections about BOK Financial Corporation, the financial services industry, the economy generally and the related responses of the government, consumers, and others, on our business, financial condition and results of operations. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “plans,” “outlook,” “projects,” “will,” “intends,” variations of such words and similar expressions are intended to identify such forward-looking statements. These various forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. For a discussion of risk factors that may cause actual results to differ from expectations, please refer to BOK Financial Corporation’s most recent annual and quarterly reports.