Personal Debit Card

Elevate your everyday spending

Unlock enhanced safety and convenience with your Bank of Oklahoma Mastercard® Debit Card. This card isn’t just for purchases – it's also your ATM card, giving you easy access to cash whenever you need it. With contactless technology, strong security features, and Mastercard’s Zero Liability protection,1 you can shop confidently and enjoy exclusive cardholder benefits—all with ease and peace of mind.

Get more from your Mastercard

Protecting you from unauthorized charges.2

Offers 24-hour assistance worldwide.1

To monitor and resolve identity theft.1

Reimburses up to $250 if a merchant will not accept a return.1

Doubles the original manufacturer's warranty for up to one year.1

For unique dining, travel and entertainment experiences.1

Tap. Pay. Done.

Paying with your contactless debit card is secure, fast and easy. Just look for the contactless symbol at checkout and tap the terminal to pay. You can also add your card to your Apple Pay, Google Pay or Samsung Pay digital wallet3 to checkout quickly and securely. If contactless isn’t available, insert or swipe your debit card as usual.

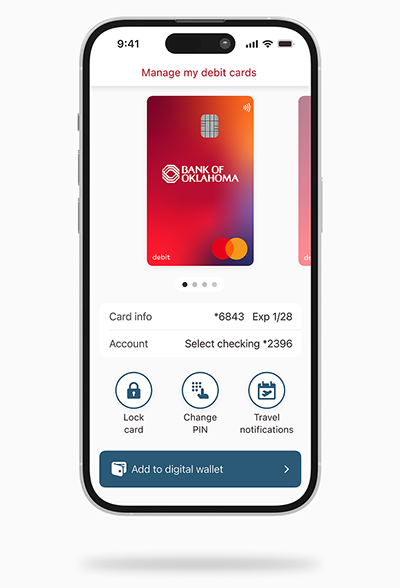

Everyday features, one easy-to-use mobile app

From changing your PIN to paying on the go, you'll love how easy it is to manage your Bank of Oklahoma Debit Mastercard® from the convenience of your mobile phone.

Lock your card

Whether your card has been misplaced or you want additional peace of mind, you can lock (and unlock) your card in the app or online.

Change your PIN

Edit your PIN in the app. Simply verify your identity, make the change and keep your account secure.

Set up your digital wallet

Add your debit card to your phone’s digital wallet and pay for purchases using your mobile phone or Apple Watch®.

Set travel notifications

Heading out of town? Add your trip to your account, so you can use your debit card while traveling without disruption.

Stay ahead of fraud with smart text alerts

Protect your debit card with real-time notifications. If we spot suspicious activity, you'll receive a text or email alert instantly.

Frequently asked questions

You can activate your card in one of three convenient ways:

- Log in on our mobile app and click the activation banner at the top of the screen, or

- Call us at 855.726.4885 and provide the information requested, or

- If activating a reissued card, make a PIN-based transaction at any ATM

Log into our mobile app and click on "More." Select "Manage my Debit Cards," then choose "Change PIN" and follow the prompts.

If you believe your card has been lost or stolen, review your transaction history to ensure all charges are accurate and authorized. If you notice any unfamiliar or suspicious activity, please contact ExpressBank immediately for assistance.

You may also log into Online Access or our mobile app to immediately lock your card.

From Mobile App:

- After logging in, click on "More" then "Manage My Debit Cards."

- For the card you need to block, toggle the "Unlocked" switch to "Locked."

- Read the pop-up that follows and confirm by tapping "Lock."

- Your card will be immediately blocked from use until you decide to turn it back on.

From Online Access, log into your account, select Manage My Debit Cards from the main menu, and follow the same prompts as above.

If you later locate your card or change your mind, simply repeat these steps, toggling the "Locked" switch back to an unlocked state. In both instances, we will email you a confirmation notification immediately.

Alternatively, you may also call ExpressBank at 800-234-6181 to temporarily lock your card.

If you believe your card needs to be replaced:

- Log into our mobile app and click on "More."

- Select "Manage My Debit Cards," then "Manage Card."

- Choose "Replace lost or stolen card" and choose the preferred option.

- You may also call ExpressBank directly at 800-234-6181.

From Online Access, log into your account, select "Manage My Debit Cards" from the main menu, and follow the same prompts as above.

If you believe your card has been used to make fraudulent purchases, contact us immediately. Your card comes with Mastercard’s® Zero Liability protection, so you won’t be liable for any unauthorized transactions you report in a timely manner. Any funds lost due to fraudulent activity will be fully restored to your account.

Contactless payments are incredibly secure and allow you to tap your card on a contactless-enabled terminal. They use advanced encryption technology to protect your card information. The tokenization process adds an extra layer of protection during a transaction by replacing all your card information with randomly generated digits that mean nothing to hackers.

While contactless acceptance is widespread, not all merchants may support it. Look for the contactless symbol on the card reader or ask the cashier if they accept contactless payments.

Whether you choose to swipe, insert or tap your card, you’ll have the option to either sign or enter your PIN for debit purchases.

Look for the contactless symbol at checkout. Then, simply tap and hold your card against the terminal to make your payment. If the terminal is not contactless enabled, simply insert or swipe your card as you normally would.

Most terminals will give you the choice to tap, insert or swipe. If the terminal is not equipped for one or more of those options, the cashier or terminal itself will prompt you accordingly.